social security tax limit 2021

Between 25000 and 34000 you may have to pay income tax on. B One-half of amount on line A.

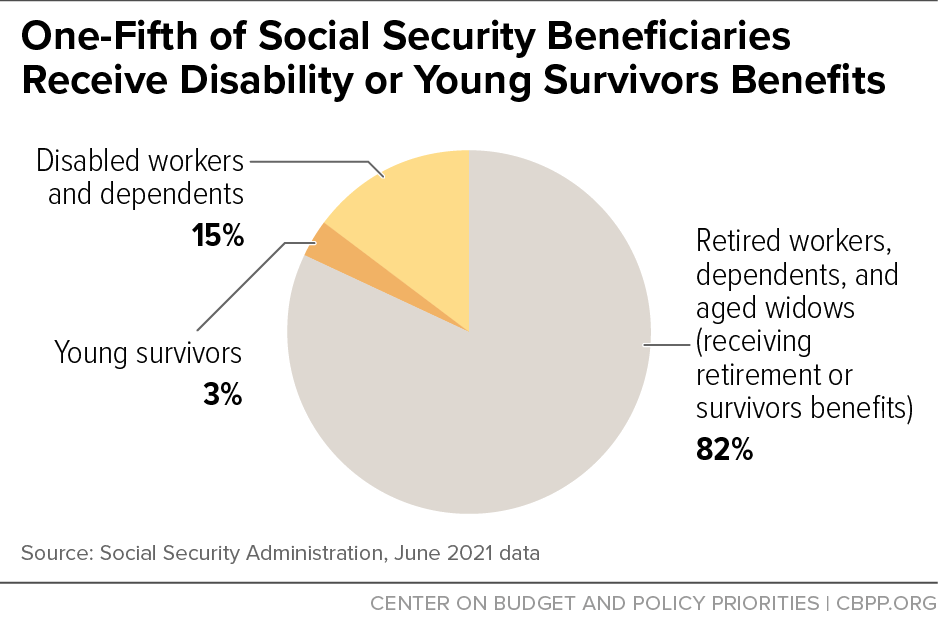

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

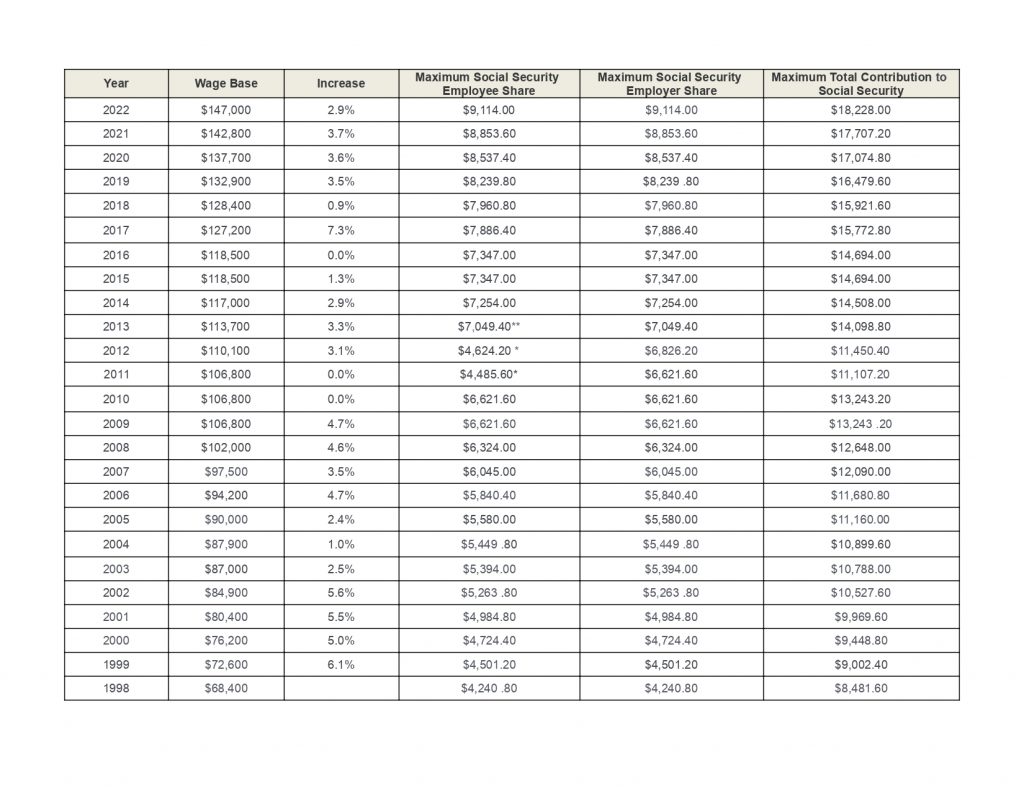

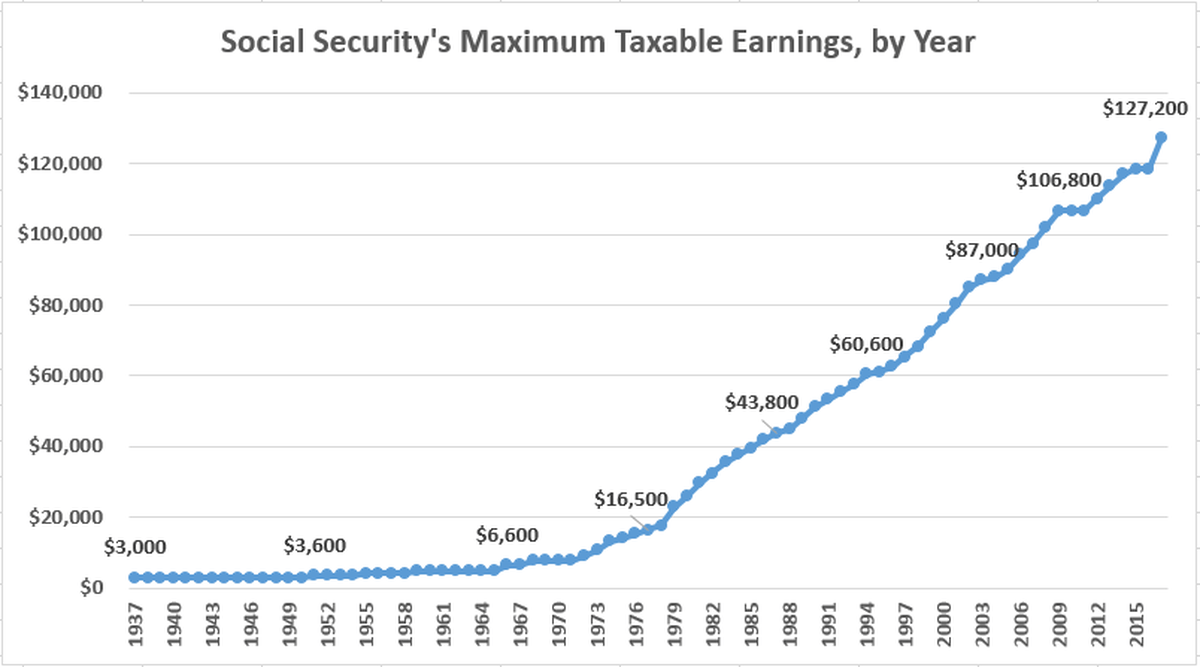

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. A Amount of Social Security or Railroad Retirement Benefits. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

For earnings in 2022 this base is 147000. If that total is more than. The standard deduction increases in 2023 will be as follows 13850 for single filer or married but filing separately 20800 for head of households and 27700 for married.

By joseph June 15 2022. 9 rows This amount is known as the maximum taxable earnings and changes each year. Only the social security tax has a wage base limit.

Social Security and Medicare taxes. Your employer would contribute an. Tax brackets for income earned in 2022.

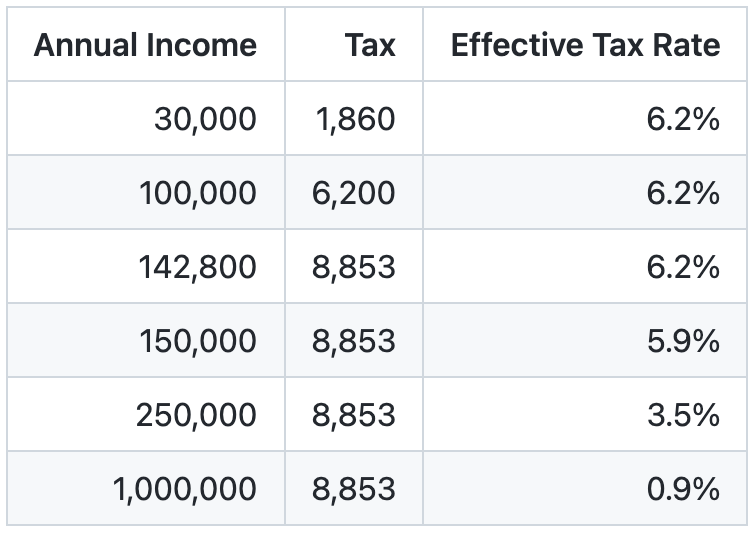

Worksheet to Determine if Benefits May Be Taxable. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. The Social Security taxable maximum is 142800 in 2021.

How to Calculate Your Social Security. The OASDI tax rate for. We call this annual limit the contribution and benefit base.

If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. This amount is also commonly referred to as the taxable maximum.

SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple. The wage base limit is the maximum wage thats subject to the tax for that year. As a result the Trustees.

It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a workers Social Security benefit. Wage Base Limits. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022.

Fifty percent of a taxpayers benefits may be taxable if they are. Workers pay a 62. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

The change to the taxable maximum called the contribution and benefit. For earnings in 2022. The Social Security Administration SSA has announced the annual cost-of-living adjustment to the maximum amount of earnings subject to Social Security tax ie the taxable.

The 2021 tax limit is 5100 more than the 2020 taxable maximum. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

Employeeemployer each Self-employed Can be offset by income tax provisions. The American Rescue Plan increased the Child Tax Credit from 2000 to 3600 per child for children under the age of six from 2000 to 3000 for children over the age of 6. The 2022 limit for joint filers is 32000.

Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021. If you earned more than the maximum in any year whether in one job or more than one we only. The maximum earnings that are taxed have changed over the years as shown in the chart below.

In 2022 the Social Security tax limit is 147000 up.

Social Security Increases For 2021 Flaster Greenberg Pc Jdsupra

Social Security What Is A Regressive Tax By Jarrett Meyer Medium

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Research Income Taxes On Social Security Benefits

2021 Wage Cap Rises For Social Security Payroll Taxes Hr Works

Tax Amount Increases For 2021 Trueblaze Advisors

Maximum Taxable Income Amount For Social Security Tax Fica

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

Social Security What Is The Wage Base For 2023 Gobankingrates

What S The Social Security Payroll Tax Limit For 2022

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable At Age 62

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Maximum Taxable Income Amount For Social Security Tax Fica

Getting Ready For Tax Season Cost Of Living Adjustment For 2021 And More Benefits Gov

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Overview Of Fica Tax Medicare Social Security

Maximum Social Security Taxes Will Increase 2 9 While Benefits Will Rise 5 9 In 2022

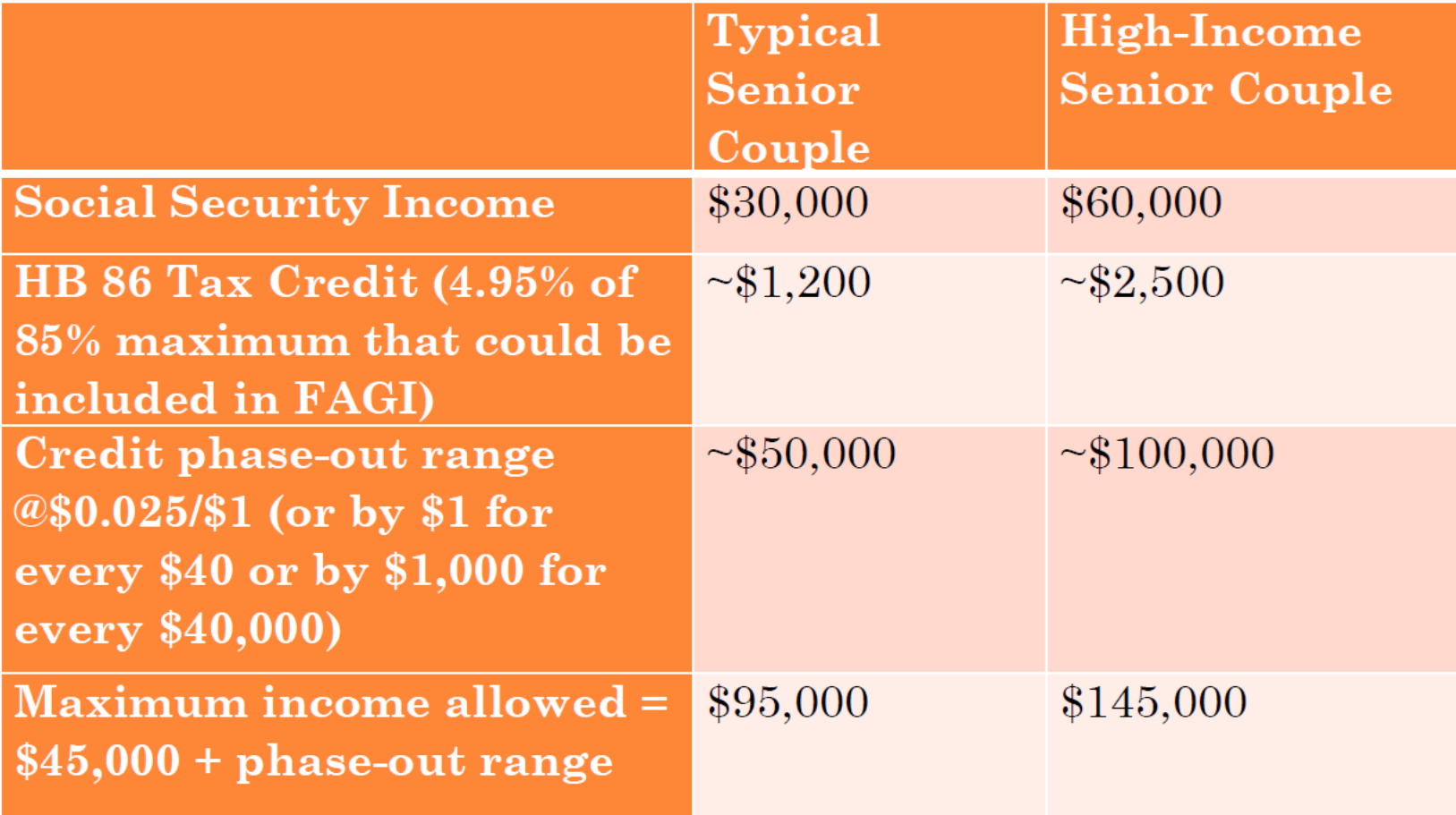

Voices For Utah Children Analysis Of Retirement Tax Credit Proposals Before The 2021 Utah Legislature

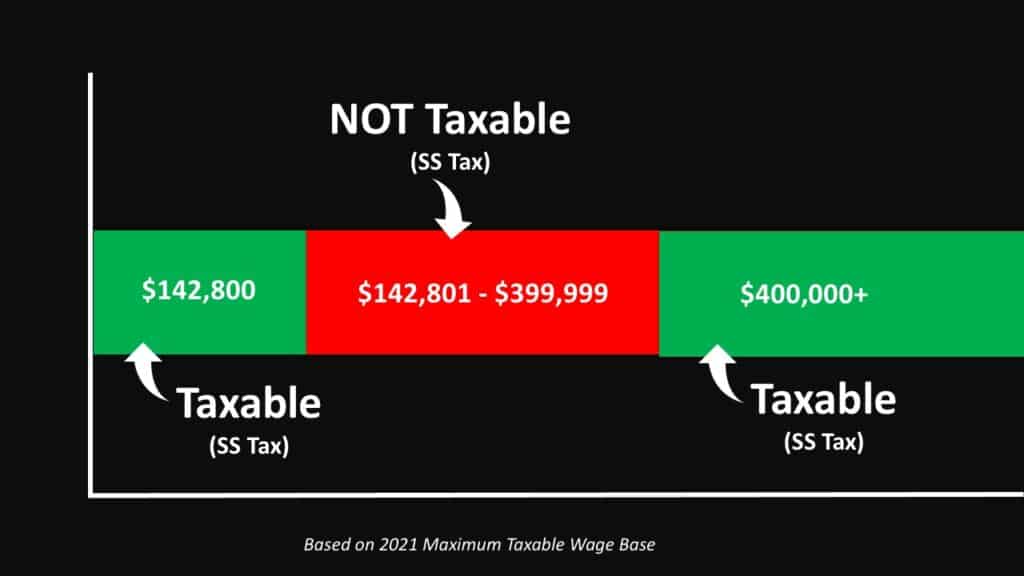

The Myth Of Fixing Social Security Through Raising Taxes Social Security Intelligence